Preliminary Thoughts on American Tower

Please feel free to reach out if you follow the name and/or other tower players

Over the course of the past week or so I have started digging into AMT for the first time. It’s one of those ones that you admire from afar for a while thinking it seems simple enough and then when you dig in the lift is heavier than expected. Never having looked at a REIT doesn’t help. I’ve probably still got a couple of days of more work to do on it but wanted to get some preliminary thoughts down on paper and hopefully find some people to talk to about it. Please feel free to DM me on Twitter - handle is stockthoughts81 or email me at stockthoughts81 at gmail dot com. Let’s get into it.

Valuation

I don’t really know how to value this thing. I’ve never seen a company that breaks down capex into six different categories so that’s kind of cool but also creates some decisions that need to be made. Right now this is the rough framework I have in mind for valuation: AFFO (as reported) - SBC + Cash Interest + Cash Taxes. And then applying a pretax multiple to that. So that is only hitting them for maintenance capex, which is a tiny fraction of the overall capex. But we’re looking at a ~55% margin on that basis. Let’s say NTM top line comes in at $11b. That ~$6b of pretax earnings. Maybe apply an, I don’t know, 15x multiple to that? So $90b EV. You don’t want to go too high on the multiple with this methodology because you are only hitting them for maintenance capex so growth is basically just price escalators, maybe 4% or something. But very long duration. By my math, that gets me to an equity value per share of $113, which is a 164 cent dollar.

Alternatively, you can give them more growth and hit them for more capex. Let’s say total capex average 15% of revenue vs 2% for maintenance capex, so knock 1300bps off the 55% margin for a new margin of 43%. $4.7b pretax earnings. This enables faster growth of, I don’t know, 8-10%? For the next 5-10 years. Rough math - using the previously mentioned 4% from escalators as a starting point, and then in 2022 total capex was 40% of AFFO so say you are reinvesting 40% of earnings at 10% ROIC should drive an additional 400bps growth. Apply a 20x multiple on our $4.7b pretax earnings and I get a $122 value per share. That’s a 153 cent dollar so the conclusion isn’t a whole lot different this way.

What Am I Missing?

Akre Capital was featured in Value Investor Insight back in November 2022 and they said they saw ~13% returns. The price is down 14% from the $217 it was at when that was published, so the IRR is now a bit higher than that from their perspective. So given my conclusion above of this being a 150-170 cent dollar, I feel like I am missing something but I am not sure what.

Other Things To Be Aware Of/I Thought Were Interesting

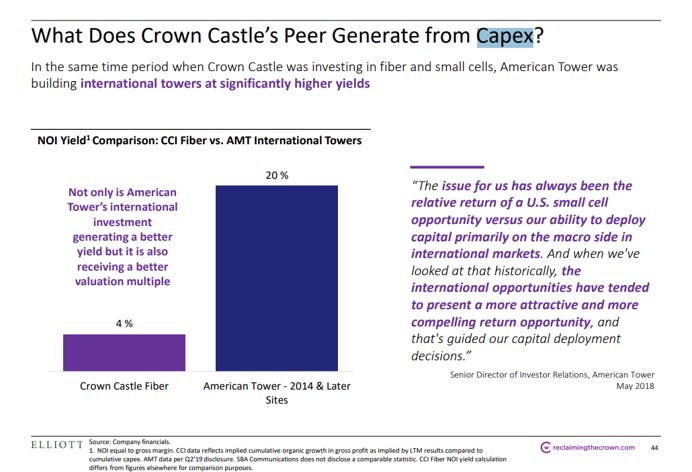

India seems to be a bit of an issue. Exploring strategic alternatives there. Possibly in talks with Brookfield. Have seen mentions of price tags of $2-4b. I would’ve thought a bit higher, but maybe India is just a tough market? But everything mgmt has said seems to suggest international returns are at least as good as domestic given lower restructuring cost. This slide from Elliott’s 2020 Crown Castle deck was interesting:

There was a rumor in January that AMT and Brookfield were going to do some sort of deal to buy Cellnex for ~50b EUR, which would be wild.

CoreSite- seems expensive? And not 100% on the strategic rationale?

I don’t know if maybe I could’ve classified some of the capex differently in my previous calculations or used slightly different growth. Where do lease amendments come in? Is redevelopment really growth capex? Etc. But I don’t think this changes things a lot.

Speaking of redevelopment capex, does anyone know what portion of that is actually reimbursed and/or how that flows through the financials?

Why doesn’t the capital expenditures number they report match the cash flow statement item “payments for purchase of property and equipment and construction activities”?

Infra funds being interested in tower assets makes the M&A landscape more competitive

Is there any sort of technological risk here? If so, what is it and on what timeframe? Nothing immediately comes to mind for me. 5G will probably be more small cell technology in dense urban areas, hence what Crown Castle is trying to do. But SBAC and AMT are mostly suburban and rural so I think towers will continue to be relevant there?

Holders of note

Akre

Digital Bridge Group - this seems super interesting, does anyone know anything about these guys? They own $179m stock which is a 21% position on the 13F but it sounds like they probably have a lot else going on. Website.

Avenir. These guys seem interesting as well. Apparently Digital Bridge is publicly traded? Anyone follow the company? From Avenir Insights: “Amidst the uncertain economic outlook, our largest holdings, American Tower and Microsoft, continue to perform well operationally, though the share prices of each business declined roughly in line with the market. The build out of 5G networks both domestically and abroad remains the primary driver for American Tower… Digital Bridge, which is in the final stages of transitioning to an asset manager focused on digital infrastructure, also started 2022 on a strong note, only to be upended by rising interest rates. Specifically, higher interest rates had a two-fold adverse impact on the valuation of the business, namely the assumed growth rate in the asset management business and a reassessment of the value of some of the company’s recent investments. Frankly, we think the market is correct to demand a higher discount rate in light of higher interest rates, but also believe the company’s long term growth prospects remain favorable given the demand for digital infrastructure across the world and management’s track record in this sector. Where appropriate, we conducted tax loss harvesting to lower our cost basis while maintaining our position in a business that has good long-term prospects.”

Broad Run

Barton Investment Management

Mar Vista

Disclosure: None of this is investment advice. I or my employer may have positions in securities mentioned.

I’d be curious about how much their interest bill is going to go up in the next few years as they refinance at higher interest rates. This is a business that really benefited from a near zero interest rate policy.